Expert Verified, Online, Free.

To be effective, compliance risk management professionals must design a framework to ensure that bank management understands the risks and the steps that must be taken to mitigate them. The many roles compliance professionals fill incorporate risk management aspects including:

Correct Answer:

D

🗳️

They also embrace the concept of risk-based compliance management. They expect compliance management to be tailored to the bank, be it large or small, offering standard or specialty financial services, simple or complex products lines, and adjusted as appropriate for the customer base as that issued for the Bank

Secrecy Act, also establishes their expectations that a bank's program be risk based. Who are they?

Correct Answer:

C

🗳️

A compliance professional's responsibilities include all of the following EXCEPT:

Correct Answer:

D

🗳️

______________ should include basic elements designed to understand and mitigate risk. It usually includes:

Written program -

Compliance-related policies and procedures

Correct Answer:

C

🗳️

In a compliance program, tactical compliance procedures should be integrated into business line procedures, such as how to deliver an Adverse Action Notice when an application is declined. In this case:

Correct Answer:

AB

🗳️

Which of the following should be done during research and interpreting regulations Compliance professionals in mitigating compliance risk?

Correct Answer:

ABD

🗳️

The compliance program should address plans to verify adherence to applicable regulations through:

Correct Answer:

A

🗳️

There is no established template for documenting compliance risk. Each institution should develop a risk assessment that fits its risk profile. The components that are commonly used throughout the industry are as follows EXCEPT:

Correct Answer:

D

🗳️

In Compliance regulation and risk assessment key performance indicators usually include:

Correct Answer:

ABC

🗳️

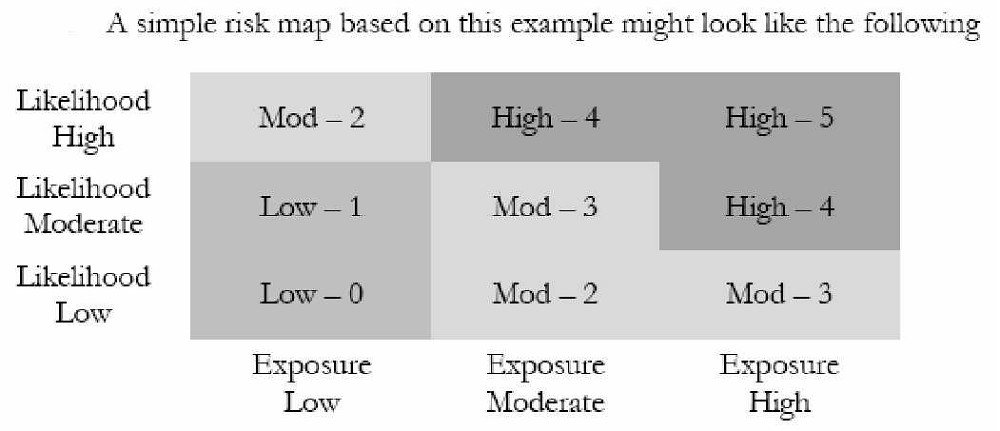

For example on a 0-5 scale:

The risk trend shows the direction of risk and probable change to risk over the next 12 months. A trend toward increasing risk means that

Correct Answer:

A

🗳️