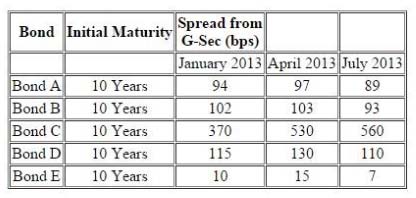

The following information pertains to bonds:

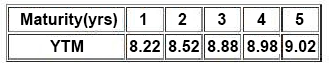

Further following information is available about a particular bond "˜Bond F'

There is a 10.25% risky bond with a maturity of 2.25% year(s) its current price is INR105.31, which corresponds to YTM of 9.22%. The following are the benchmark YTMs.

From the time January 2013 to April 2013, what can you predict about the market conditions, assuming the G-Sec has not changed?

Comments