HOTSPOT -

A company is implementing Microsoft Dynamics 365 Finance. The company plans to implement the Fixed asset module.

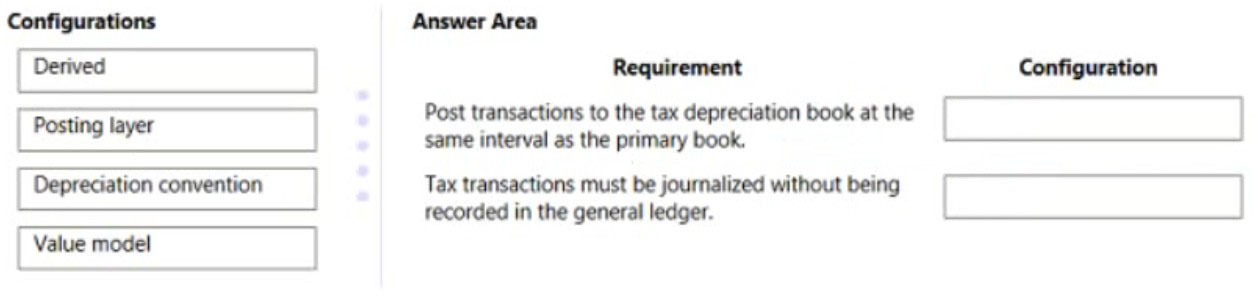

You have the following requirements:

✑ Post transactions to the tax depreciation book at the same interval as the primary book.

✑ Tax transactions must be journalized without being recorded in the general ledger.

You need to configure the fixed asset books.

Which configuration option should you use? To answer, drag the appropriate configurations to the correct requirements. Each configuration may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

Select and Place:

globeearth

1 month, 2 weeks agoKev_Sharp

9 months agocs_b

1 year, 3 months ago