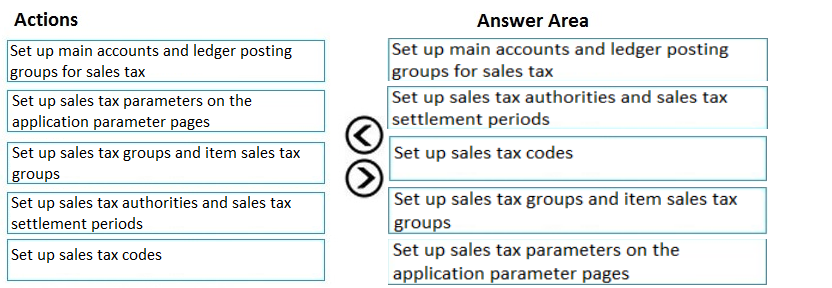

DRAG DROP -

A retail company has outlets in multiple locations. Taxes vary depending on the location.

You need to configure the various components of the tax framework.

In which order should you perform the actions? To answer, move all actions from the list of actions to the answer area and arrange them in the correct order.

Select and Place:

saadnadir

Highly Voted 3 years, 6 months agoangie97

Most Recent 1 year agoBenLearn

2 years, 6 months agosadiq_d365

3 years, 10 months agosadiq_d365

3 years, 10 months agoDDV

4 years agokripe86

1 year, 11 months ago