Kevin Rathbun, CFA, is a financial analyst at a major brokerage firm. His supervisor, Elizabeth Mao, CFA, asks him to analyze the financial position of Wayland,

Inc. (Wayland), a manufacturer of components for high quality optic transmission systems. Mao also inquires about the impact of any unconsolidated investments.

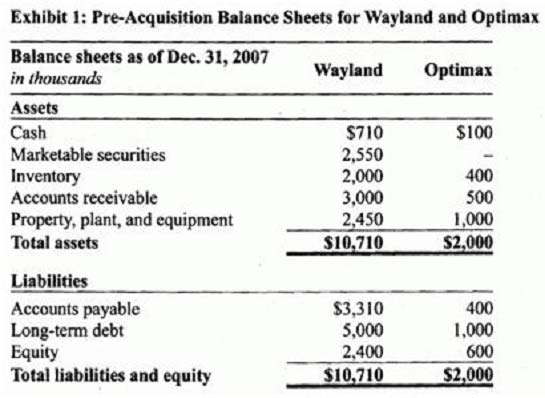

On December 31,2007, Wayland purchased a 35% ownership interest in a strategic new firm called Optimax for $300,000 cash. The pre-acquisition balance sheets of both firms are found in Exhibit 1.

On the acquisition date, all of Optimax's assets and liabilities were stated on its balance sheet at their fair values except for its property, plant, and equipment

(PP&E), which had a fair value of $1.2 million. The remaining useful life of the PP&E is ten years with no salvage value. Both firms use the straight-line depreciation method.

For the year ended 2008, Optimax reported net income of $250,000 and paid dividends of $100,000.

During the first quarter of 2009, Optimax sold goods to Wayland and recognized $15,000 of profit from the sale. At the end of the quarter, half of the goods purchased from Optimax remained in Wayland's inventory.

Wayland currently uses the equity method to account for its investment in Optimax. However, given the potential significance of the investment in the future,

Rathbun believes that a proportionate consolidation of Optimax may give a clearer picture of the financial and operating characteristics of Wayland.

Rathbun also notes that Wayland owns shares in Vanry, Inc. (Vanry). Rathbun gathers the data in Exhibit 2 from Wayland's financial statements. The year-end portfolio value is the market value of all Vanry shares held on December 31. All security transactions occurred on July 1, and the transaction price is the price that

Wayland actually paid for the shares acquired. Vanry pays a cash dividend of $1 per share at the end of each year. Wayland expects to sell its investment in

Vanry in the near term and accounts for it as held-for-trading.

Wayland owns some publicly traded bonds of the Rotor Corporation that it reports as held-to-maturity securities.

What amount should Wayland report in its balance sheet as a result of its investment in Optimax at the end of 2008?

Danyela

4 weeks, 1 day ago