William Jones, CFA, is analyzing the financial performance of two U.S. competitors in connection with a potential investment recommendation of their common stocks. He is particularly concerned about the quality of each company's financial results in 2007-2008 and in developing projections for 2009 and 2010 fiscal years.

Adams Company has been the largest company in the industry but Jefferson Inc. has grown more rapidly in recent years. Adams's net sales in 2004 were 33-

1/3% higher than Jefferson but were only 18% above Jefferson in 2008. During 2008, a slowing U.S. economy led to lower domestic revenue growth for both companies. The 10-k reports showed overall sales growth of 6% for Adams in 2008 compared to 7% for 2007 and 9% in 2006. Jefferson's gross sales rose almost

12% in 2008 versus 8% in 2007 and 10% in 2006. In the past three years, Jefferson has expanded its foreign business at a faster pace than Adams. In 2008,

Jefferson's growth in overseas business was particularly impressive. According to the company's 10-k report, Jefferson offered a sales incentive to overseas customers. For those customers accepting the special sales discount, Jefferson shipped products to specific warehouses in foreign ports rather than directly to those customers' facilities.

In his initial review of Adams's and Jefferson's financial statements, Jones was concerned about the quality of the growth in Jefferson's sales, considerably higher accounts receivables, and the impact of overall accruals on earnings quality. He noted that Jefferson had instituted an accounting change in 2008. The economic life for new plant and equipment investments was determined to be five years longer than for previous investments. For Adams, he noted that the higher level of inventories at the end of 2008 might be cause for concern in light of a further slowdown expected in the U.S. economy in 2009.

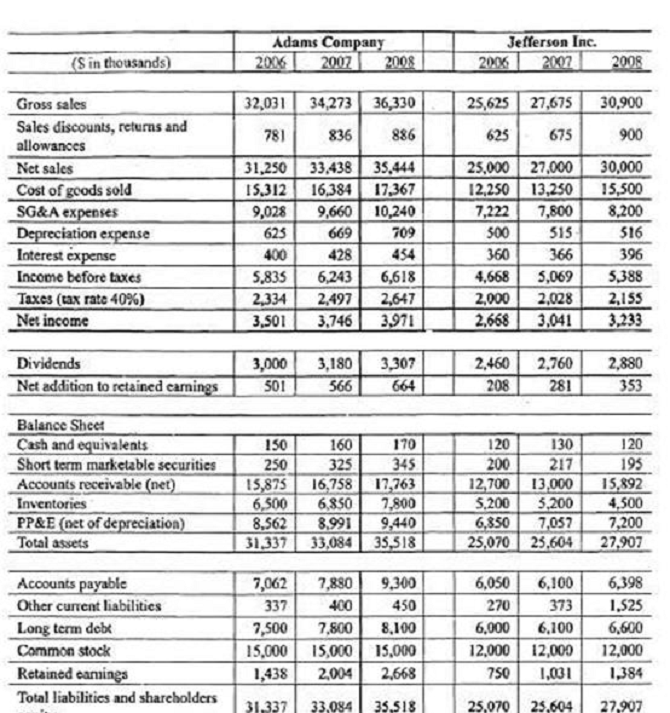

The accompanying table shows financial data for both companies' Form 10-k reports for 2006-2008 used by Jones for his analysis. To evaluate sales quality, he focused on trends in sales and related expenses for both companies as well as cash collections and receivables comparisons. Inventory trends relative to sales and the number of days' sales outstanding in inventory were determined for both companies. Expense trends were examined for Adams and Jefferson relative to sales growth and accrual ratios on a balance sheet and cash flow basis were developed as overall measures of earnings quality.

The quality of earnings as measured by balance sheet based accruals ratios showed:

Danyela

1 week, 2 days ago